“`html

Create Cryptocurrency: A Simple Guide to Building Your Own in 2025

Embarking on the journey to create cryptocurrency is an exhilarating venture for enthusiasts and experts alike. With the rapid advancements in blockchain technology and increasing interest in digital currencies, the year 2025 offers a prime opportunity for individuals and organizations intending to launch their own cryptocurrencies. This article provides a comprehensive guide to understanding the necessary steps, concepts, and considerations in the realm of cryptocurrency development.

Understanding Cryptocurrency Development

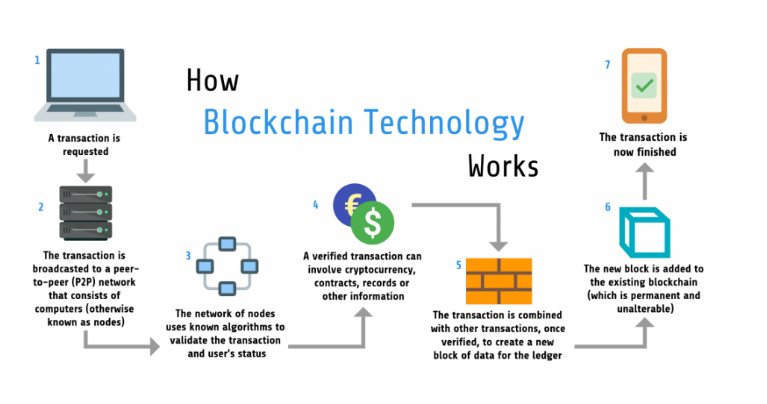

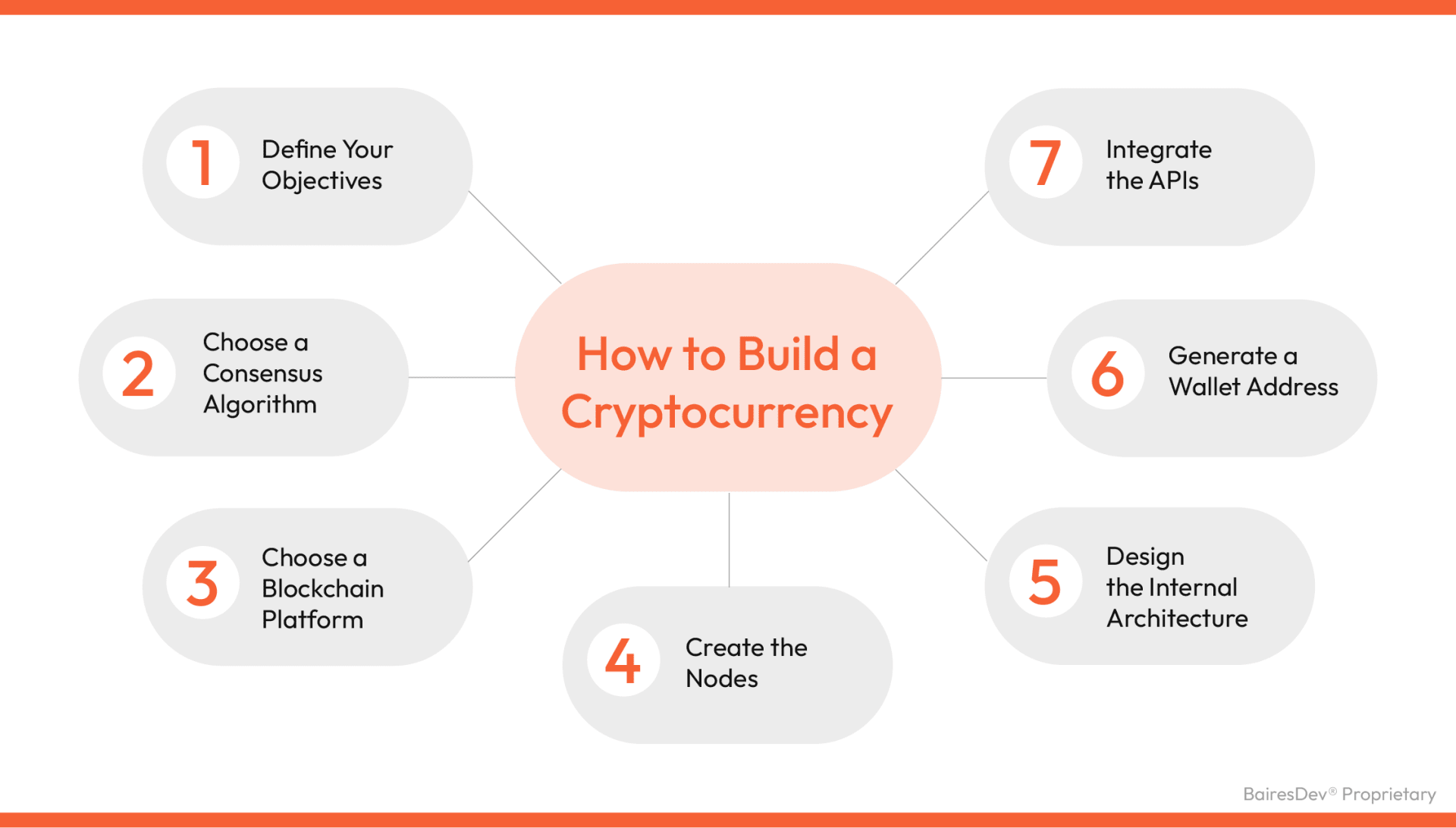

To effectively build a cryptocurrency, a fundamental understanding of the key components involved in cryptocurrency development is necessary. The process involves several stages, from ideation to the final launch on an appropriate cryptocurrency platform. It starts with identifying the purpose of the new cryptocurrency. Is it for enabling peer-to-peer transactions, supporting decentralized finance (DeFi), or perhaps facilitating digital asset management? Clear goals will guide the technical development, ensuring the cryptocurrency serves its intended audience effectively.

Key Components of Cryptocurrency

Typically, a new cryptocurrency features several crucial components: the blockchain it operates on, the consensus algorithm it employs, and the governance model guiding its evolution. Platforms might choose to build on established protocols such as Ethereum for ERC-20 tokens or opt for an entirely new open-source blockchain. Moreover, understanding cryptocurrency scalability and what it entails, such as transaction speed and network capacity, is vital to facilitating widespread adoption.

Choosing the Right Blockchain Technology

The choice of blockchain technology is among the most impactful decisions you’ll make when launching a cryptocurrency. Some blockchains prioritize speed and efficiency, making them suitable for token creation, while others may focus on security, making them better for tasks such as cryptocurrency mining or hosting smart contracts. Furthermore, prospective developers must evaluate blockchain security measures to protect against potential threats and vulnerabilities.

Creating Tokenomics and Governance Models

Establishing tokenomics, or the economic model governing your currency, is crucial for long-term success. This includes plans for token distribution, circulation strategies, and the mechanisms for incentivizing users, such as yield farming or liquidity pools. In addition, a well-thought-out governance model ensures community engagement and provides users the power to influence decisions while maintaining decentralization.

The Process of Launching Your Cryptocurrency

The actual launch of a cryptocurrency typically encompasses multiple stages—one vital phase being token launch events, which are fundamental to generating interest and sales. Whether conducting an initial coin offering (ICO) or an initial exchange offering (IEO), careful planning and effective marketing strategies are imperative for success. Early phases might also include rigorous cryptocurrency auditing to verify the integrity of the code and trustworthiness of the offering.

Marketing Strategies for Cryptocurrency

Effective cryptocurrency marketing is paramount for navigating an increasingly crowded landscape. Engaging community members and cryptocurrency enthusiasts via platforms like social media, crypto forums, and digital marketing strategies can create sustainable buzz and build a strong community. Communicating transparently about your cryptocurrency’s vision and technological underpinning fosters trust and integrity, critical elements in today’s market where many projects are scrutinized with skepticism.

Regulatory Compliance and Cryptocurrency Regulations

With the rapid evolution of the cryptocurrency landscape, adhering to cryptocurrency regulations has become a necessity. Understanding regional and global regulations impacting ICOs, taxes, and trading practices can help ensure that your project stays compliant while minimizing market-entry risks. Consider consulting with blockchain experts to navigate evolving rules impacting the crypto industry.

Utilizing Cryptocurrency Exchanges

Choosing the right cryptocurrency exchange for listing your token is a critical step post-launch. Different exchanges offer varying advantages in terms of user base, trading volume, and guidance through the coin listing process. Popular trading platforms can help achieve visibility and liquidity, boosting the success rate of your cryptocurrency.

Investing in Cryptocurrency: Risks and Strategies

No exploration of cryptocurrency is complete without addressing the associated risks and strategies for managing investments. The crypto market is notorious for its volatility, posing significant risks for investors. Implementing sound investment strategies, such as setting a defined risk tolerance and thorough market analysis, can safeguard against unexpected drops in price.

Understanding Market Trends

An understanding of crypto market dynamics and emerging trends is essential when investing in any cryptocurrency. Keeping abreast of developments concerning regulation, technology forks, and market sentiment can steer your investment decisions and foster better returns. Utilizing market analysis tools can help you draw insights on price trends and potential investment strategies.

Best Practices for Cryptocurrency Trading

Applying best practices in cryptocurrency trading involves continuous education and risk management. Building an investment portfolio diversified across various assets reduces overall risk while capitalizing on potential opportunities in upwards market cycles. By joining online cryptocurrency communities, investors have access to valuable insights and shared experiences that aid in improving trading practices.

Studying Successful Cryptocurrency Projects

Taking note of successful cryptocurrency projects and understanding their strategies can provide potential blueprints for new entrants in the market. Analyze past ICO reports, community engagement models, and marketing efforts that have yielded high market capitalization. Reviewing historical cryptocurrency price predictions can help forecast your cryptocurrency’s trajectory and prepare for adjustments along the way.

Key Takeaways

- Understanding the core components of cryptocurrency development is vital before launching.

- Effective tokenomics and governance models are crucial for long-term project sustainability.

- Marketing strategies and community engagement play a significant role in building trust.

- Compliance with existing cryptocurrency regulations helps minimize risks.

- Investors should employ sound strategies based on continuous market analysis and education.

FAQ

1. What are the initial steps to create a cryptocurrency?

The initial steps include defining the purpose of your cryptocurrency, selecting the appropriate blockchain technology, and drafting a solid plan for tokenomics. Careful consideration of the target audience can also guide the technical developments that follow.

2. How does tokenomics contribute to cryptocurrency success?

Tokenomics defines how the cryptocurrency functions within an ecosystem, detailing the supply mechanisms, utility, and incentives. A well-structured tokenomics model enhances the value proposition and encourages user participation.

3. What are common challenges in cryptocurrency marketing?

Key challenges include differentiating from countless other projects, building trust in a skeptical market, and navigating changing regulation influences. Crafting a robust community engagement plan can address these challenges effectively.

4. How can I ensure my cryptocurrency remains compliant with regulations?

Staying informed about the latest cryptocurrency regulations is essential. Consultation with legal experts and adapting your project as laws evolve can ensure continued compliance and mitigate risks.

5. What role do exchanges play in the success of a cryptocurrency?

Choosing the right cryptocurrency exchange can significantly impact your project’s visibility and user acquisition. It provides a platform for trading, enhancing liquidity and capturing the interest of potential investors.

6. What affects the volatility of cryptocurrencies?

Market sentiment, regulatory changes, liquidity, and macroeconomic factors often drive cryptocurrency volatility. Understanding these aspects can help investors make informed predictions and manage risks better.

7. How important is community engagement for new cryptocurrencies?

Community engagement is crucial for fostering trust, gathering feedback, and ensuring adoption. A strong community can significantly enhance the longevity and success of a cryptocurrency while joining discussions in forums can be a valuable step.

“`